The 1099MISC has Copy A, B, C, 1 and 2 Copy A is sent to the IRS along with the 1096 Copy B is sent to the recipient and the recipient keeps that copy The payer or the business issues the 1099MISC forms to vendors/contractors should retain Copy C1099MISC Payer Copy C Availability In stock Use the 1099MISC Payer Copy C for Payer files Year * * Required Fields Buy 50 for $018 each and save 25% ;If you are required to file Form 1099C, you must retain a copy of that form or be able to reconstruct the data for at least 4 years from the due date of the return Requesting TINs You must make a reasonable effort to obtain the correct name and TIN of

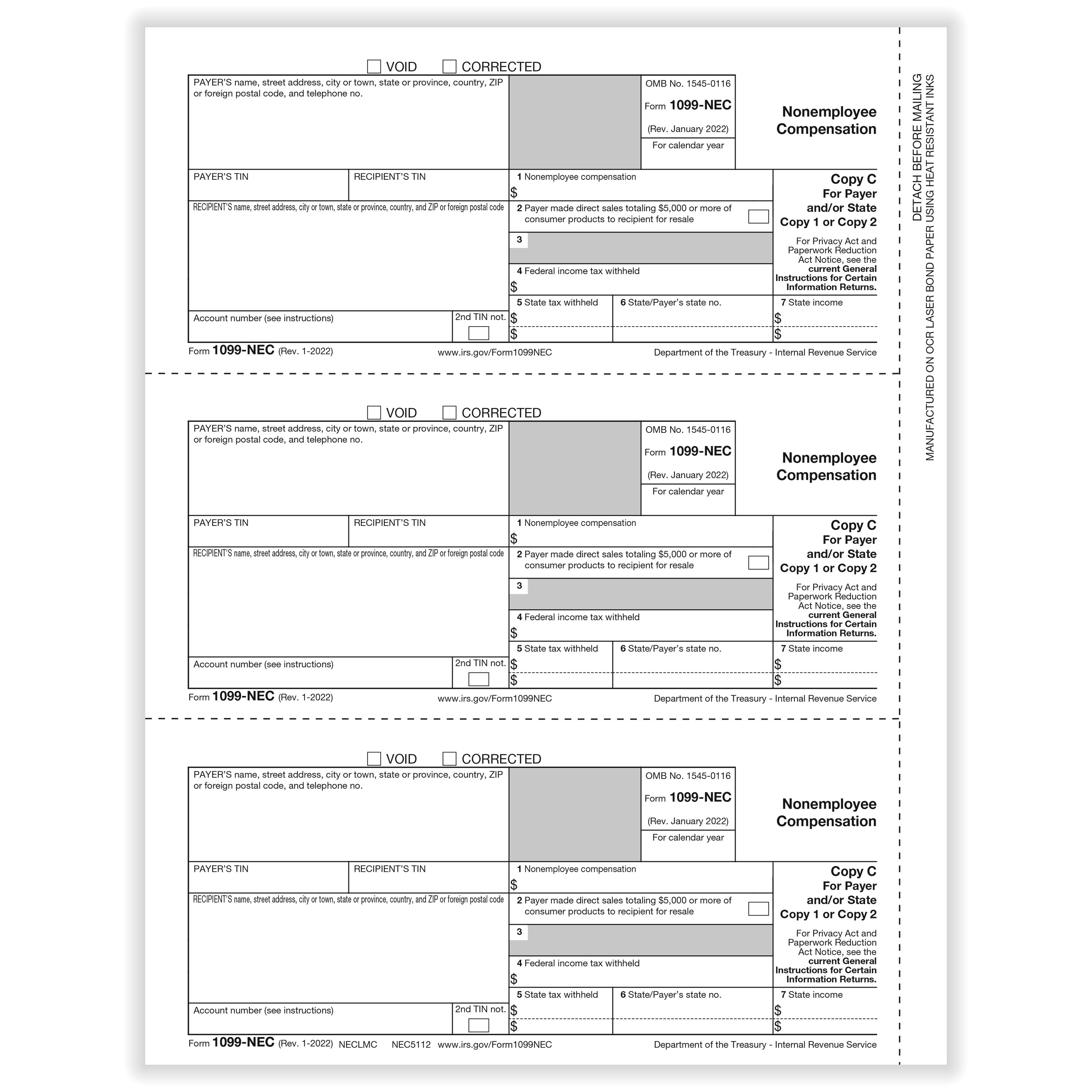

1099 Nec Forms