Bolster your personal finance knowledge with the Mind Over Money Learning Modules As you set your personal financial goals and get curious to learn more, book a session with a Financial Coach to take your next steps toward financial wellnessThe Mind Over Money program is a campuswide financial literacy effort with the mission to equip students with the financial knowledge to make informed financial decisions It strives to provide personal finance resources and guidance to all students and to serve as a foundation that will guide students in their lives and careers beyond The Farm 1819 Student PhotographersBudgeting After College Unread Grad Student Budgeting

Students Stanford Federal Credit Union

Mind over money stanford

Mind over money stanford-Mind Over Money aims to serve as a campuswide resource to equip students with a foundation to make informed financial decisions during their time at Stanford and in their careers and lives after the Farm Mission To be an accessible program, integral to the Stanford community, that offers reliable tools, diverse resources,ECON 111 Money and Banking The primary course goal is for students to master the logic, intuition and operation of a financial system money, financial markets (money and capital markets, debt and equity markets, derivatives markets), and financial institutions and intermediaries (the Central Bank, depository institutions, credit unions, pension funds, insurance companies, venture capital

How To Write The Stanford University Essays 21

Mind Over Money è stata fondata da un gruppo di esperti di pluriennale esperienza nel mondo del management, della consulenza e della ricerca nel settore finanziario e assicurativo Realizziamo sistemi per lo sviluppo di servizi di nuova generazione rivolti a banche, compagnie assicurative e professionisti della consulenzaTo expedite your payment, please use Stanford ePay Due to pandemicrelated delays, please allow 24 weeks for paper check processing Read student communications sent from our office here Mind Over Money Budgeting Workshop Student AffairsInvesting Overview Unread Value vs Growth

Mind Over Money programs and information on this website are for educational purposes only Information is not intended to be a substitute for specificMind Over Money's free 11 financial coaching program provides students with universitytrusted individuals with whom to share their personal financial circumstances, and the opportunity to explore ideas, concepts, and resources Find a Financial CoachEquipping students with the foundation to make informed financial wellness decisions during their time at Stanford, in their careers, and lives after the Farm!

Calculations are based on a student entering Stanford in fall 19 This calculator works best if you enter values from completed 17 federal income tax returns If your tax return is not available, you can use estimated figures but the results may not be as reliable Taxrelated losses and depreciation allowed in tax law do not reduce totalAn eyeopening and entertaining investigation into the power money holds over us, Mind over Money will change the way you view the cash in your wallet and the figures in your bank account forever Mind over Money is an invaluable resource for anyone fascinated by the dynamics of money and for those wishing to learn how to maximize its power and greatest benefitBuying vs Leasing a Car Calculator Red dotted lines indicate the end of the lease period or car loan

Amazon Com Inside The Investor S Brain The Power Of Mind Over Money Peterson Richard L Books

Stanford Fcu Stanfordfcu Twitter

About Stanford GSB About Our Degree Programs About Us ; Directed by Malcolm Clark With Lance Lewman, Gary Becker, Ben Bernanke, Zach Burns Nova examines the science behind making financial decisions and investigates why economists did not anticipate the 08 financial crisisBanks and Credit Unions Transportation Costs Insurance

Stanford The Landlord Affordability Tensions Rise Between Graduate Students And University The Stanford Daily

Mind Over Money

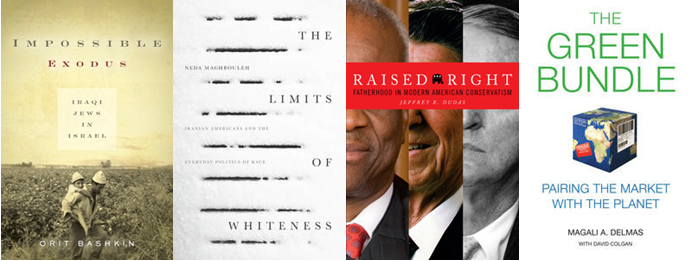

Richard L Peterson, Inside the Investor's Brain The Power of Mind over Money (Wiley 07) Richard Peterson is a medical doctor with a residency in psychiatry, and with postgraduate training in neuroeconomics from Stanford UniversityMind Over Money programs and information on this website are for educational purposes only Information is not intended to be a substitute for specificVision Mind Over Money's vision is to operate a bestinclass program on the Stanford campus that increases all students' financial wellness with impactful, relevant, and researchinformed programming and resources Goals To equip students with the knowledge and skills, confidence, and motivation to increase healthy financial behaviors during and after the Farm To democratize

What Does The Saying Mind Over Matter Mean Quora

Personal Finance Resources For Stanford Students Mind Over Money

Mind Over Money Financial Coaches Financial coaching is an educational service for students and Young Alumni who wish to develop skills and behaviors (eg tackle a financial challenge or to learn about a personal finance topic) to improve upon independently over time Our coaches are Stanfordaffilated volunteersProvided to by DistroKidMind Over Money (feat Jaysfl & DeadStockDaniiee) Dade 3hreeMind Over Money (feat Jaysfl & DeadStockDaniiee)℗ 4TG RecordsR"Mind Over Money" premieres April 27th on PBS (please check local listings) In the aftermath of the worst financial crisis since the Great Depression, NOVA

When The Medalists Aren T The Money Makers The Stanford Daily

Deronnie Pitts Cep Cfp Director Capital Markets Carta Linkedin

Stanford Mind Over Money 10 likes Education WebsiteVideo Packages and Process https//yourcharlesalexanderlpagesco/howdoesthisworkvideooptin/My website http//wwwyourcharlesalexandercom/LinkedIFeature "Stanford's Mind Over Money Program Fosters Financial Literacy" Read full article on Stanford News >> "Figuring Out Your Form W4" Read more on Forbes >> "This is Your Brain on Credit Cards" See full article on The Atlantic >> SEPT 13, 17 "Stanford

Mind Over Money

Mind Over Money Financial Coaches Mind Over Money

Special Announcement New Mind Over Money website launching Spring 18!Prior to Stanford, she was a commercial lender with Union Bank for 13 years Mind Over Money programs and information on this website are for educational purposes only Information is not intended to be a substitute for specific individualized tax, legal or investment planning advice Mind Over Money, a program of Student Financial Services, is guided by a Leadership Advisory Board, which includes staff members from offices and programs across campus, including Stanford

Resources For Graduating Students And Young Alumni Mind Over Money

Mind Over Misery Stanford Magazine

International students considered nonresidents for tax purposes cannot easily or efile their taxes and as such, Stanford University provides GlacierTax Prep software for these students Filing on Paper While filing by hand is intimidating, it can be a fairly straightforward process Start by looking at Form 1040EZ Stanford University has an immediate opening for a fulltime Associate Director of the Mind Over Money Financial Wellness Program This position will be in the Division of Student Affairs, which supports a variety of student experiences outside the classroom in our residences, community centers, student organizations, health center, and career education center and isMind Over Money equips students with the knowledge to make informed financial decisions during Stanford and in their careers beyond graduation Visit Mind Over Money at Stanford Mind Over Money is supported by the Charles Schwab Foundation, a nonprofit dedicated to financial education and empowerment The information presented on this site, including external

Mind Over Money Overcoming The Money Disorders That Threaten Our Financial Health Klontz Brad Klontz Ted Amazon Com Books

Personal Finance Resources For Stanford Students Mind Over Money

How to File Taxes Unread Tax Breakdown Calculator Unread Marginal vs Effective Tax Rate Unread Effective Tax Rate Calculator Unread Education and TaxesTranscript Mind Over Money PBS Airdate NARRATOR Does raw human emotion dictate your financial decisions, or are we rational calculators of our own selfinterest?"Mind Over Money is a valuable resource for individuals wanting to break free from a troubled financial past and create a healthy current relationship with money that can create future financial success It is Must reading on everyone's Now list" Philip Zimbardo, PhD, Professor Emeritus of Psychology, Stanford University,

Stanford Mind Over Money Photos Facebook

Top Colleges Aren T What You Think Npr

To post a message to all the list members, send email to mindovermoney_financial_literacy@listsstanfordedu You can subscribe to the list, or change your existing subscription, in the sections below Subscribing to mindovermoney_financial_literacy Subscribe to mindovermoney_financial_literacy by filling out the following form "Mind Over Money is a lifeline for anyone who thinks of money as a way to secure happiness, love, or define their selfworth I know because I was driven by these unhealthy behaviors that almost put my family and me in financial crisisIf you find that you are in need of additional financial support, please know that there are many resources for you through Stanford, and beyond As a place to start, check out Mind Over Money's resource page on Graduate Student Financial Assistance

Mind Over Money The Psychology Of Money And How To Use It Better Hammond Claudia Amazon Com Books

Personal Finance Learning Modules Mind Over Money

Thanks for your interest in the Associate Director, Mind Over Money Program position Unfortunately this position has been closed but you can search our 765 open jobs by clicking here Review of "Mind over money" Just watched a PBS Nova documentary called "Mind over money" It's a film about two competing models of economics, referred to in the show as 'rationalist economics' and 'behavioralist economics' 'Rationalists' model each human being as being self interested and perfectly rational in pursuing the maximization ofSolving the Matching Problem Our hypothesis is that a major factor in behavior change is matching people will the right behaviors, we are working with the Mind Over Money team to create an expansive list of financial behaviors that promote wellbeing then we are testing different methods of matching students with behaviors and looking at which ones lead to the highest level of behavior

Stanford Offers New Expanded Financial Wellness Opportunities For Students Stanford News

Students Stanford Federal Credit Union

Mind Over Money, a financial wellness program in Student Affairs, provides free resources, workshops, and financial coaching for all students, postdocs, and young alumni The goals of the program include equipping students with knowledge and skills to make informed decisions, democratizing access to information, and fostering a campus culture of healthy financialTo expedite your payment, please use Stanford ePay Due to pandemicrelated delays, please allow 24 weeks for paper check processing Read student communications sent from our office here Mind Over Money Financial Literacy Resources Student AffairsMind Over Money DocumentaryMoney is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts in a pa

Students For Workers Rights Labor At Stanford In The Time Of Coronavirus By Center For Comparative Studies In Race Ethnicity Full Spectrum Medium

Research All Money Is Not Created Equal Stanford Graduate School Of Business

Doug has over years of private equity investment experience He is currently a Managing Director with MIG Private Equity where he runs its global private equity investment activities Prior to joining MIG, Doug was a Partner at FBB, a private equity group that managed over $250MM primarily for the Bass Brothers of Fort Worth, TX In this capacity, Doug invested in manyMIND OVER MONEY Change Your Thoughts, Change Your Financial Future a Stanford Psychologist, has shown that language doesn't just express otherwise universal still others destroy precious relationships over money Then, there are people, some of whom have less money,Mind Over Money, a financial wellness program in Student Affairs, provides free resources, workshops, and financial coaching for all students, postdocs, and young alumni The goals of the program include equipping students with knowledge and skills to make informed decisions, democratizing access to information, and fostering a campus culture of healthy financial

Difference Making College Financial Literacy Programs Lendedu

Personal Finance Resources For Stanford Students Mind Over Money

Mind Over Money 21 followers on LinkedIn Mind over Money Consulting Inc is a community partner recognized for delivering needed financial education and financial coaching opportunities to

Mind Over Money The Psychology Of Money And How To Use It Better Hammond Claudia Amazon Com Books

2

Mind Over Money Overcoming The Money Disorders That Threaten Our Financial Health Klontz Brad Klontz Ted Amazon Com Books

Stanford University Vpue Approaching Stanford Handbook 19 Page 58 59 Created With Publitas Com

Mind Over Money Financial Coaches Mind Over Money

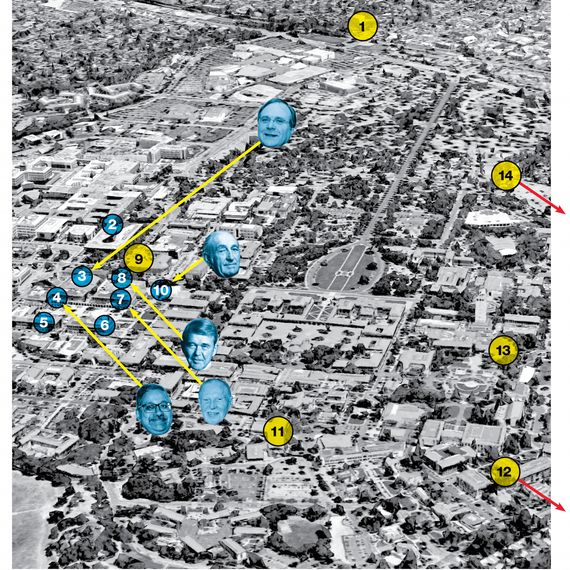

John Rice Cameron Wants To Make Stanford Great Again Stanford Politics

Stanford Mind Over Money Home Facebook

Mind Over Money

Resources For Graduating Students And Young Alumni Mind Over Money

Mind Over Money Finance Coach For Black Women

Mind Over Money

Stanford S Mind Over Money Program Fosters Financial Literacy Stanford News

Stanford Study Says Rankings Do Not Point Students To The Best College Fit

Mind Over Money Financial Coaches Mind Over Money

Resources For Graduating Students And Young Alumni Mind Over Money

Mind Over Money Nova Pbs

Mind Over Money Finance Coach For Black Women

Kelly Takahashi Director Of Strategic Operations And Finance For Student And Academic Services Stanford University Linkedin

Mind Over Matter May Actually Work When It Comes To Health Study Finds

Mind Over Money Financial Coaches Mind Over Money

Resources For Graduating Students And Young Alumni Mind Over Money

Mind Over Money

Personal Finance Resources For Stanford Students Mind Over Money

Flinances Summer Money Management Mind Over Money

Mind Over Money Financial Coaches Mind Over Money

Mind Over Money Office Hours Student Financial Services

Chemwell Mind Over Money Workshop Mind Over Money

Recorded Workshops For Stanford Students Mind Over Money

How To Save More Money Npr

Mind Over Money Capital One

Recorded Workshops For Stanford Students Mind Over Money

Mind Over Money

Mind Over Money Financial Coaches Mind Over Money

Mind Over Money

Mind Over Money

Mind Over Money Financial Coaches Mind Over Money

Mind Over Money

3

Mind Over Money Financial Coaches Mind Over Money

Personal Finance Resources For Stanford Students Mind Over Money

How To Write The Stanford University Essays 21

Stanford University Cost Options Edmit

Stanford Mind Over Money Photos Facebook

Resources For Graduating Students And Young Alumni Mind Over Money

Mind Over Money Financial Coaches Mind Over Money

Mind Over Money Financial Coaches Mind Over Money

Financial Basics For Entering Medical Students Ppt Download

Freelance Danna Gallegos

Mind Over Money

Stanford Moves To Stop Providing Funds To Its University Press

Resources For Graduating Students And Young Alumni Mind Over Money

How To Network Your Way Through Stanford University

Mind Over Money Financial Coaches Mind Over Money

The Grumpy Economist University Finances

Mind Over Money Financial Coaches Mind Over Money

Mind Over Money Financial Coaches Mind Over Money

Mind Over Money Capital One

Mind Over Money

Mind Over Money

Stanford Flip Happening Tomorrow Twitter

Financial Aid Entrance Counseling Session Wednesday September 18

Personal Finance Resources For Stanford Students Mind Over Money

First Gen Low Income And Claiming A Community Stanford Magazine

Mind Over Money

/cdn.vox-cdn.com/uploads/chorus_asset/file/19577734/1172033932.jpg.jpg)

Inside Mind The Gap The Secretive Silicon Valley Group That Has Funneled Over Million To Democrats Vox

Resources For Graduating Students And Young Alumni Mind Over Money

3 Things Money Does To Your Brain Inc Com

Financial Aid Entrance Counseling Session Wednesday September 18

Mind Over Money Financial Coaches Mind Over Money

Personal Finance Resources For Stanford Students Mind Over Money

Mind Over Money Behavior Design Lab

Stanford Mind Over Money Home Facebook

Mind Over Money Office Hours Student Financial Services

Mind Over Money

Mind Over Money Kirkus Reviews

Stanford University Athletics Programs College Factual

Stanford Mind Over Money Home Facebook

0 件のコメント:

コメントを投稿