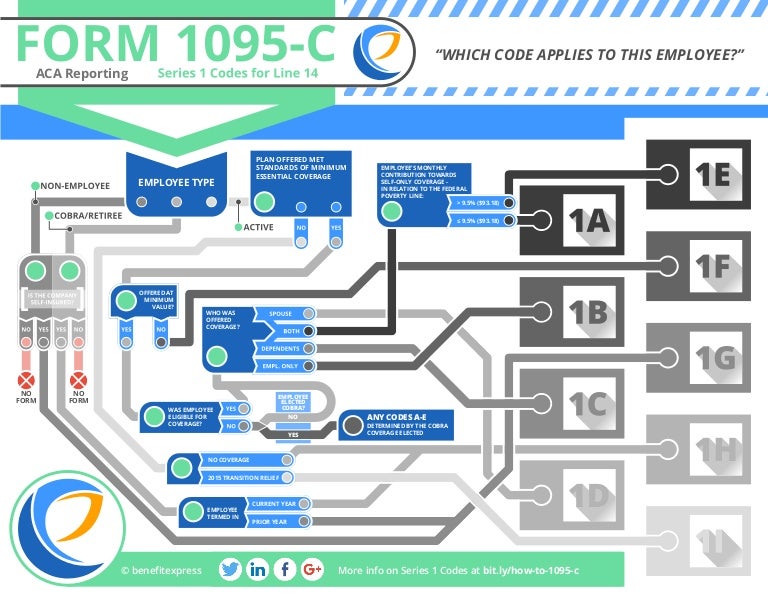

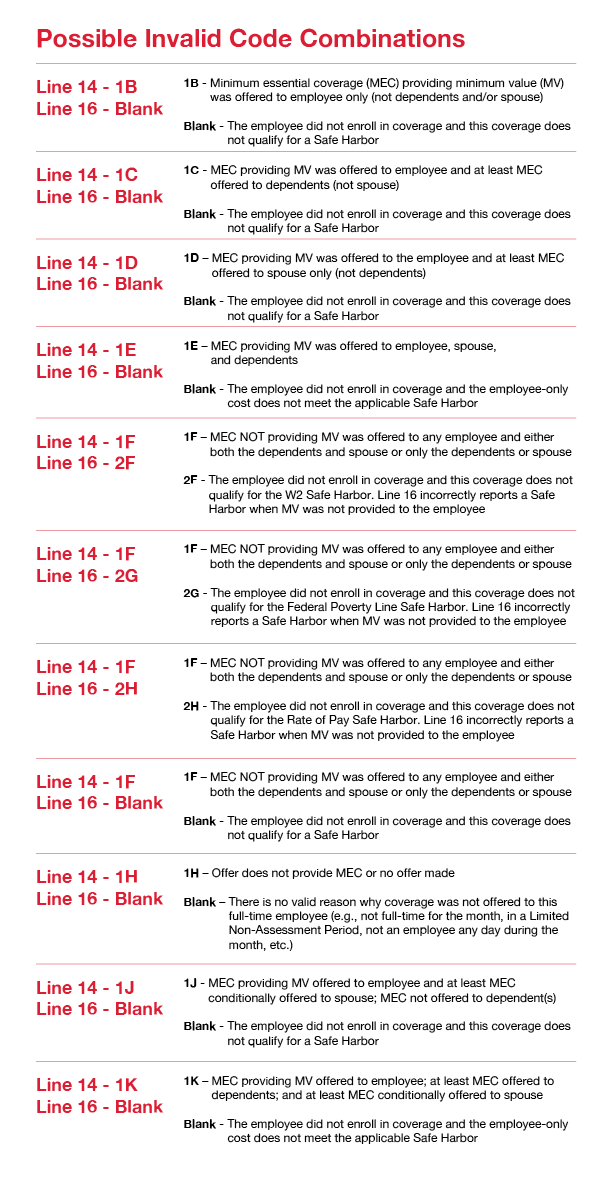

Minimum essential coverage not offered to dependent(s) (See Conditional offer of spousal coverage, for an · Applicable Large Employers (ALEs) with 50 or more fulltime or fulltime equivalent employees are required to file Form 1095C What are the changes to Form 1095C for ? · When populating Form 1095C, employers are communicating a lot of information through a series of codes on Lines 14 and 16 It is incredibly important for an employer to have documentation supporting the codes they are using when populating the Forms 1095C Below is a general breakdown of the different codes that could be entered on Lines 14 and 16 of Form 1095C

Irs Issues Draft Form 1095 C For Aca Reporting In 21

2017 form 1095-c codes

2017 form 1095-c codes-Form 1095C, Line 16 So, like we said, line 14 takes care of telling the IRS what type of coverage you offered · Last week our Health Care Reform article explained the Codes for completing Line 14 of Form 1095C This week we focus on completing Line 16 of Form 1095C Applicable Large Employers (those with 50 or more fulltime/fulltime equivalent employees in the prior year) should be in the process of completing their ACA forms

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

1095C Form and Associated Codes ACA Reporting Payroll Data Aggregation Benefit Eligibility Tracking Benefit Contribution Invoicing and Reconciliation Charitable Contributions General Purpose of Forms 1095C and 1094C Basics of the 1095C Form Reporting Employer Compliance Part II (Lines 1416) · The line 14 codes 1T through 1Z are also listed on the draft Form 1095C and state that they will be reserved for future use We recommend these codes be eliminated for the final copy as they serve no purpose and have never been assigned under any iteration of the Form5/10/17 · The IRS has released final Forms 1094C and 1095C (C Forms) and final instructions for the C Forms for the 17 tax year (Final Forms 1094/1095B, but not the instructions, have also been released We'll cover those items in a separate

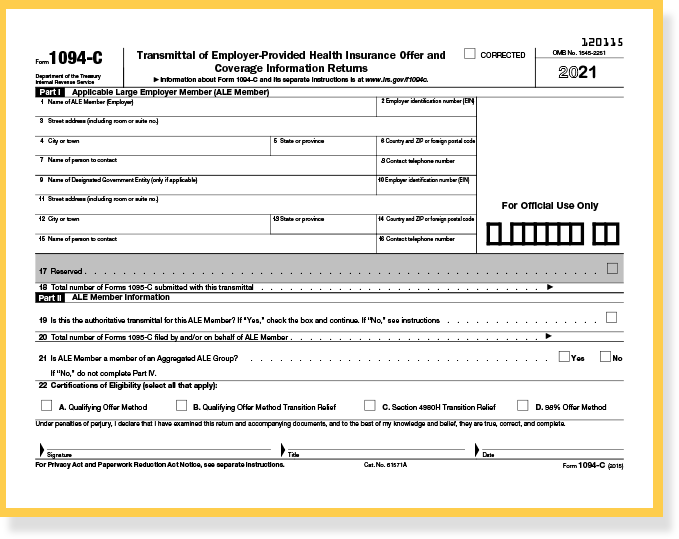

· On Line 14 of Form 1095C, employers are prompted to enter a code that describes the type of health coverage offered to a particular employee during the tax year See below for a breakdown of the different codes that your organization can use to populate on Line 14IRS Form 1095C Indicator Codes for Lines 14, 15, and 16 Form 1095C, Part II, Line 14 Indicator Code Series 1 for "Offer of Coverage" 1A Qualifying Offer Minimum essential coverage providing minimum value offered to fulltime employee with employee contribution for self only coverage equal to or less than 95% mainland singleForm 1094C must be used to report to the IRS summary information for each employer and to transmit Forms 1095C to the IRS Form 1095C is used to report information about each employee In addition, Forms 1094C and 1095C are used in determining whether an employer owes a payment under the employer shared responsibility provisions under section 4980H

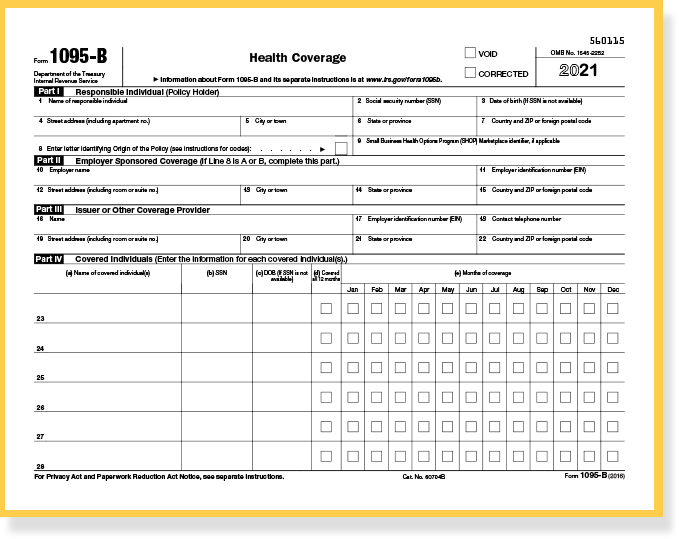

· Use the 1095B and C forms to show what coverage a worker had, what months they had coverage, or to show self insured coverage You'll file one form per employee If an employer provided selfinsured coverage This section is used forNo Form 1095C need be filed for 16 since employee not a fulltime employee B) If employee averaged 30 hours or more during the measurement period, the employee must be offered coverage for the succeeding stability period Assuming the employee enrolls in that coverage, Lines 14 16 of Form 1095C would be completed as follows · Code 1A alert On January 26, 16, the IRS revised ACA reporting guidance on how employers document a qualifying offer of health coverage on Form 1095C

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Irs Form 1095 C Codes Explained Integrity Data

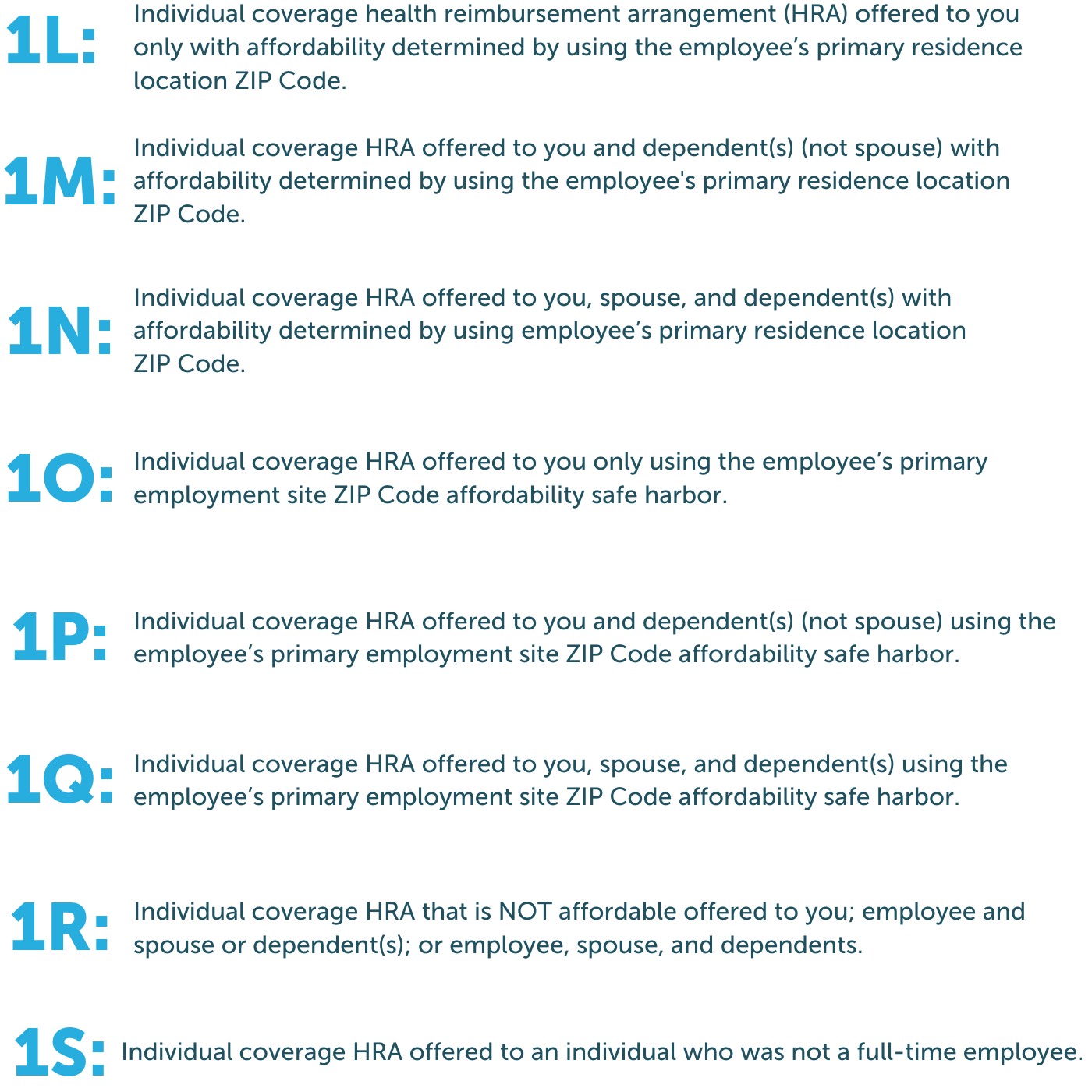

Form 1095C Code Series 1 and 2 The Affordable Care Act (ACA) added two employer reporting requirements to the Internal Revenue Code (Code), which will take effect for 15 reporting Code § 6056 requires applicable large employers (ALEs) to provide an annual statement to each fulltime employee detailing the employer's health coverage offer (or lack of offer) · For tax year , Form 1095C gets updated with brandnew offer codes employers can enter in line 14 You'll use it to indicate the type of HRA coverage offered to employees In all, eight new codes are available for these arrangements, including code 1L, "individual coverage HRA offered to you only with affordability determined by using employee's primary residence location ZIP code" · Form 1095C may be sent electronically like the W2 if the IRS electronic distribution requirements are met, but the employer must receive consent from the employee separate from the W2 All of the 1095C forms must be submitted with the 1094C If you are filing over 250 1095C forms, you are required to file electronically February 28th, 16

1095 C Employer Provided Health Insurance Offer Of Coverage

Common Mistakes In Completing Forms 1094 C And 1095 C

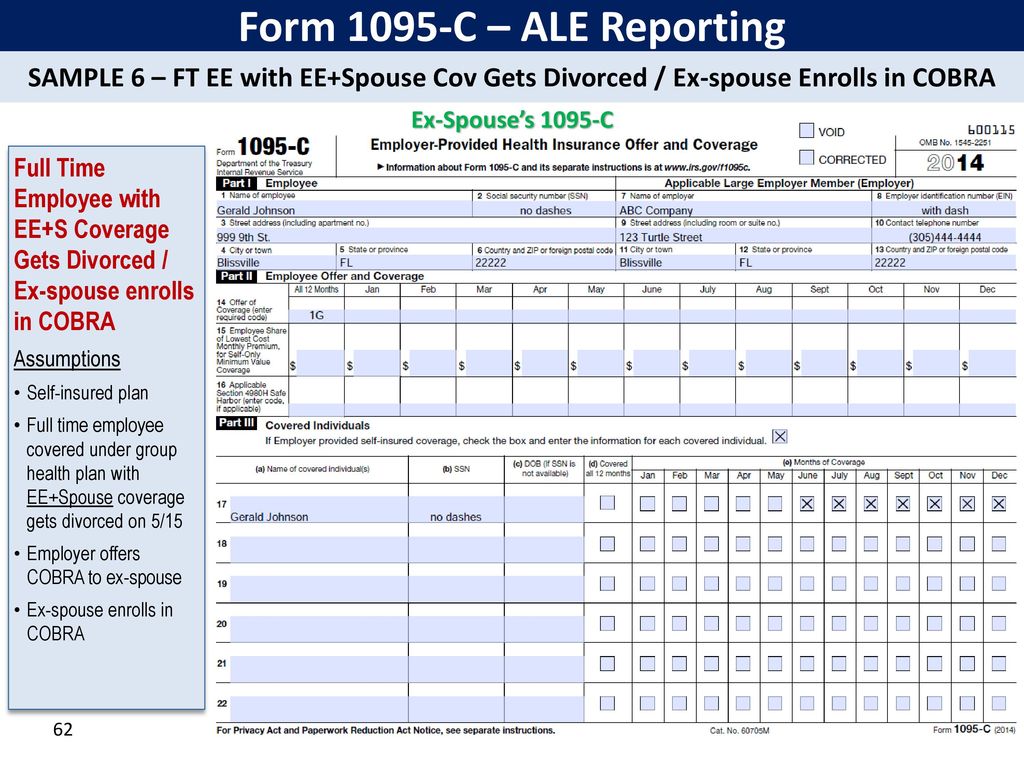

9/03/15 · If using form 1095C for COBRA reporting, you would enter codes 1G and 2A in part II lines 14 and 16, respectively Line 15 is not required as affordability is not assessed for COBRA individuals Do retirees who receive health insurance benefits need form 1095C · Key Points about completing Form 1095C You have until March 2, 21 to deliver Form 1095C to your employees The codes you use to complete these forms depend on the coverage you offer, whether your employee enrolls, and other employment changes We outline common example scenarios to help you choose the appropriate codes for lines 14 and 16Form 1095 C Line 14 Offer of Coverage Line 14 describes the health coverage plan that you offer to your employer, spouse, and other dependents The IRS states 17 codes to enter on line 14 based on the plan offered They are 1A, 1B, 1C, 1D, 1E, 1F, 1G, 1H, 1J, 1K, 1L, 1M, 1N, 1O, 1P, 1Q, and 1S

Accurate 1095 C Forms A Primer Erp Software Blog

1095 C Faqs Mass Gov

Form 1095C Code Series 1 (Line 14 of Form 1095C) Code Series 2 (Line 16 of Form 1095C) Whether Employees Were Offered Coverage Type of Coverage Offered Months Coverage Offered FullTime or PartTime Employment Coverage Enrollment Transition Relief Eligibility IRS Safe Harbor Whether Coverage was Affordable Let ACAwise handle your ACA Reporting7/02/17 · One of the most important parts of the Form 1095C is how you indicate data about the coverage you offered each employee You do this using Code Series 1 and Code Series 2 in lines 14 and 16 of Form 1095C The IRS then reviews these codes to make sure you have everything running smoothly and compliantly with your ACA employer requirements9/05/18 · Employee not employed during the month Enter code 2A if the employee was not employed on any day of the calendar month Do not use code 2A for a month if the individual was an employee of the ALE Member on any day of the calendar month Do not use code 2A for the month during which an employee terminates employment with the ALE Member 2B

Accurate 1095 C Forms Reporting A Primer Integrity Data

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

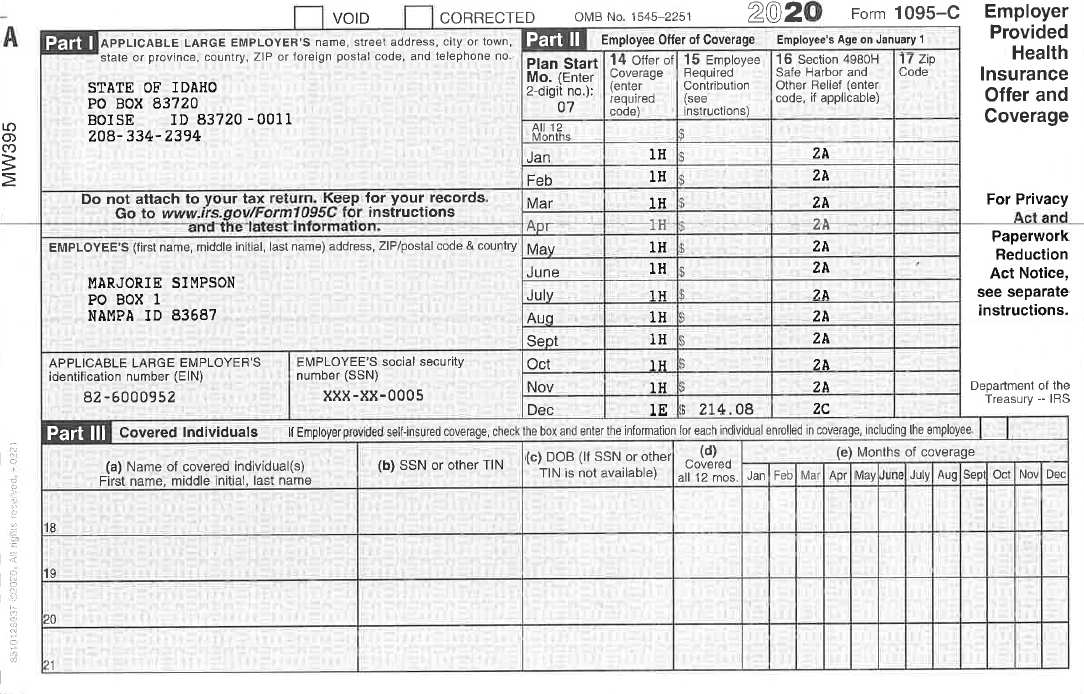

· Below is Form 1095C from the IRS website This guide will explain each piece of the form and help you determine the proper codes for the fields in Part II Shown below in blue, Parts I and III are comprised of lines 113 and 1734, respectively These sections are easy enough, just employee informationForms 1095B and 1095C should be kept with tax records Do not submit them to the IRS or Massachusetts Department of Revenue To view your Form 1095C in HR/CMS SelfService For anyone who previously chose suppression of paper forms, the Form 1095C is already available online at HR/CMS SelfServiceIf you received a Form 1095C from your employer and you're not sure what the codes mean, check out our 1095C Decoder to learn more Select a line below to learn more Lines 113 Line 14 Line 15 Line 16 Lines 17 Lines 10

Common 1095 C Scenarios

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

IRS Reporting Tip #2 Form 1095C, Line 14, Code 1A Versus 1E, and When to Use 1I Posted by Robin Broyles on Tue, Mar 22, 16 @ 1303 PMRegister for our BernieU course, Intro to Forms 1094C and 1095C, where we cover everything from the history of the forms to tactical tips and tricks to help you streamline filing and reduce errors–all inFor the months April through December, on Form 1095C, Employer A should enter code 1H (no offer of coverage) on line 14, leave line 15 blank, and enter code 2A (not an employee) on line 16 (since Employee is treated as an employee of Employer B and not as an employee of Employer A in those months), and should exclude Employee from the count of total employees and fulltime

Irs Reporting Tip 2 Form 1095 C Line 14 Code 1a Versus 1e And When To Use 1i Innovative Benefits Planning

Ty Draft Forms 1095 C And 1094 C Released Along With New Form 1095 C Codes Press Posts

Calculating the 1095C Lines 1416 codes is one of the more daunting tasks of ACA reporting For 15 tax reporting, many employers found themselves relying on their "best guesses" to correctly determine and complete their 1095C Part II codes UnifyHR has created a Guide to provide an overview of IRS Form 1095C and the required Part II Codes to empower you with theACA Code Reference Guide Form 1095C Line 16 – Code Series 1 Important Note Regarding Affordability References to affordability relate to affordability at the employee only coverage level It does not matter if the employee actually elects coverage for him or · We just talked about how important line 14 is to complete Form 1095C and now we get to tell you all about line 16 and its very own set of codes!

Form 1095 C Payroll Baylor University

Sample 1095 C Forms Aca Track Support

Line 14 of the 1095C is where an employer reports an offer of coverage that is or is not made to an employee The offer is reported by using one of nine codes,Line 14 of IRS Form 1095C lists a code that describes whether an employee was offered coverage by their employer, the type of the coverage offered, and for which months the coverage was offered The form generation feature in the Zenefits ACA Compliance app will automatically input the applicable code, which specifies the type of coverage, if any, offered to the employee, theForm 1095C Line 14 Codes, Offer of Coverage Whether the employees' received an offer of coverage or not and What type of health coverage was offered Which months that health coverage was offered

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer

What S New For Tax Year Aca Reporting Air

· Information from Form 1095C will also be used in determining whether an individual is eligible for a premium tax credit Line 14 of the 1095C is where an employer reports an offer of coverage that is or is not made to an employee The offer is reported by using one of nine codes, which are referred to as "Code Series 1" codesCode Series 2 for Form 1095C, Line 16 Updated February 28, 19 For Administrators and Employees Line 16 of IRS Form 1095C lists a code that describes, for each month in the previous year, the kind of coverage that an employee enrolled in, and how the employer meets the employer shared responsibility "Safe Harbor" provisions of Section 4980HForm 1095C Line 14–Code Series 1 A Series 1 code must be entered in line 14 to indicate the type of coverage offered (or no coverage offered) to the employee and family Enter a code for each month, or enter one code in the "all 12 months" box if the same code applies for the entire calendar year "Spouse" means the employee's spouse

Free 1095 C Resource Employee Faqs Yarber Creative

Irs Releases Form 1095 With Changes For Ichra Plans Health E Fx

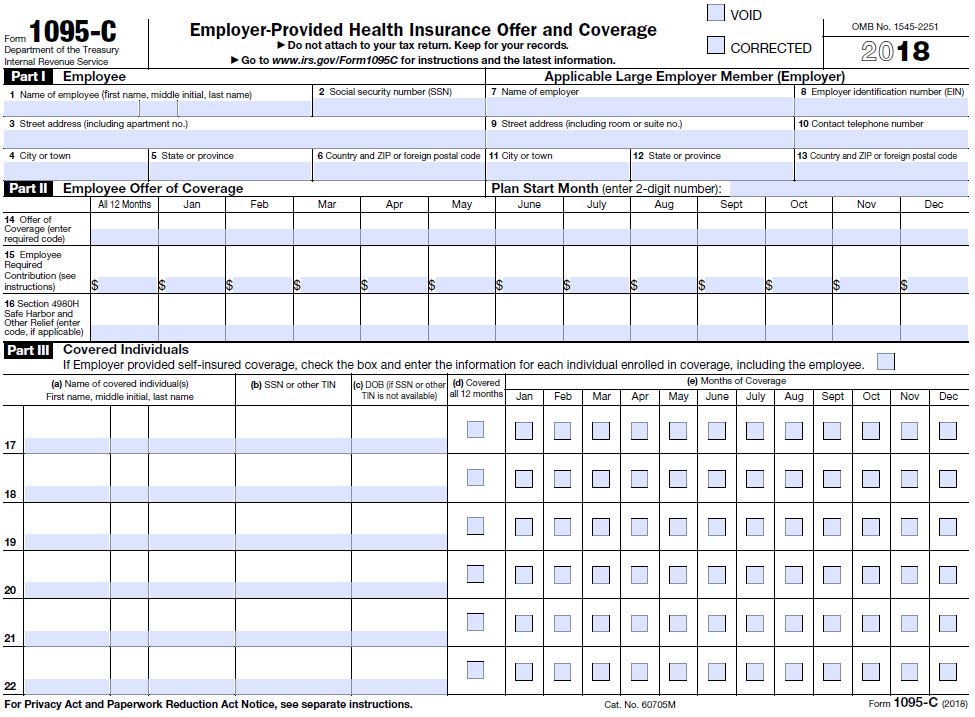

Form 1095C Department of the Treasury Internal Revenue Service EmployerProvided Health Insurance Offer and Coverage Do not attach to your tax return Keep for your records Go to wwwirsgov/Form1095C for instructions and the latest information VOID CORRECTED OMB No 18 Part I Employee 1 Name of employee (fForm 1095C What is Form 1095C?/10/ · Every ALE needs to provide a Form 1095C with Lines 1416 completed with the correct information Here is a breakdown of each line and what the corresponding codes mean Line 14 – Offer of Coverage Line 14 specifies the type of coverage, if any, offered to an employee, spouse, and dependents

Sample 1095 C Forms Aca Track Support

Understanding Your 1095 C Documents Aca Track Support

Reference Guide for Part II of Form 1095C Lines 14, 15, and 16 (revised for the final 17 forms) November 17 • Lockton Companies L O CKT O N CO M P ANIES GLOSSARY Children means an employee's biological and adopted children (including children placed with the employee for adoption), from birth, adoption, or placement through the end of the month in which the childThere are specific changes to the Form 1095C to reflect the reporting of ICHRAs First, there is an entirely new line that captures the employee's zip code, Line 17CODES FOR IRS FORM 1095C CODE SERIES 1 (continued) 1J Minimum essential coverage providing minimum value offered to employee and at least minimum essential coverage conditionally offered to spouse;

Aca Reporting Faq

Code Series 1 For Form 1095 C Line 14

Updated on January , 21 1030am by, TaxBandits For the calendar year , the IRS has updated Form 1095C with few changes It includes the introduction of new codes and lines for reporting Individual Coverage HRAsKeep in mind that this new form should be used only forForm 1095 Code Definitions Lines 14, 15, and 16 Line 14 Offer of coverage code 1A Qualifying Offer Minimum essential coverage providing minimum value offered to fulltime employee with employee contribution for selfonly coverage equal to or less than 95% mainlandForm 1095C Line 16Code Series 2 Code Code Meaning When Code should be Used 2A Employee (EE) not employed on any day during the month EE is not hired yet, do not use for the month they are hired if hired midmonth EE was Terminated, but don't use for the month the EE was terminated 2B EE Not a Full Time employee

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

New 1095 C Codes Will Apply To The Tax Year Aca The New 1095 C Codes For Explained

The Form 1095C contains important information about the healthcare coverage offered or provided to you by your employer Information from the form may be referenced when filing your tax return and/or to help determine your eligibility for a premium tax credit · What does 1H mean on 1095C form 1H is No offer of coverage (you were NOT offered any health coverage or you were offered coverage that is NOT minimum essential coverage) This indicates that the employer did not provide4/02/21 · The IRS has announced a postrelease addition to the codes for the Form 1095C (see our Checkpoint article)According to an IRS website post, an applicable large employer that offers an individual coverage HRA (ICHRA) can use two previously reserved codes from Code Series 1 on Form 1095C, line 14, for reporting offers of coverage for

1095 C Form Printable Fill Online Printable Fillable Blank Pdffiller

1095 C Corrections Support Center

Our ACA experts break down all 1095 C codes and walk you through how to fill out lines 14, 15, 16, and 17 and Part III Avoid penalties from the IRS learn the differences between codes!Form 1095C is divided into three parts Part I is used to identify the employee, and the reporting ALE entity It includes demographic information such as name, contact and demographic information, Social Security Number (SSN) and Employer Identification Number (EIN) Part II of the IRS Form 1095C includes three significant items Lines 14, 15 & 16 These lines together paint a05 Code Series 2 – Line 16 06 Filling Out Form 1095C Page 2 Want to learn more about preparing and filing Forms 1094C and 1095C?

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

Irs Final Aca Compliance Forms Now Available Bernieportal

Section 6056 Large Employer Reporting Ts1099 Ts1099

Aca Code Cheatsheet Release Notes

The New 1095 C Codes For Explained

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Overview Of 1095c Form

Form 1095 C Series 1 Code Map

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Irs Mailing Deadline February 28 Aca Gps

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Accurate 1095 C Forms A Primer Erp Software Blog

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

What You Need To Know About Aca Annual Reporting Aps Payroll

Code Series 2 For Form 1095 C Line 16

Toast Payroll Common Combinations Form 1095 C Codes

Aca 1095 C Code Cheatsheet

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

1095 C Software For Tracking Reporting Passport Software

Form 1095 C Released New Codes New Deadlines

Irs Form 1095 C Codes Explained Integrity Data

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

Irs Issues Draft Form 1095 C For Aca Reporting In 21

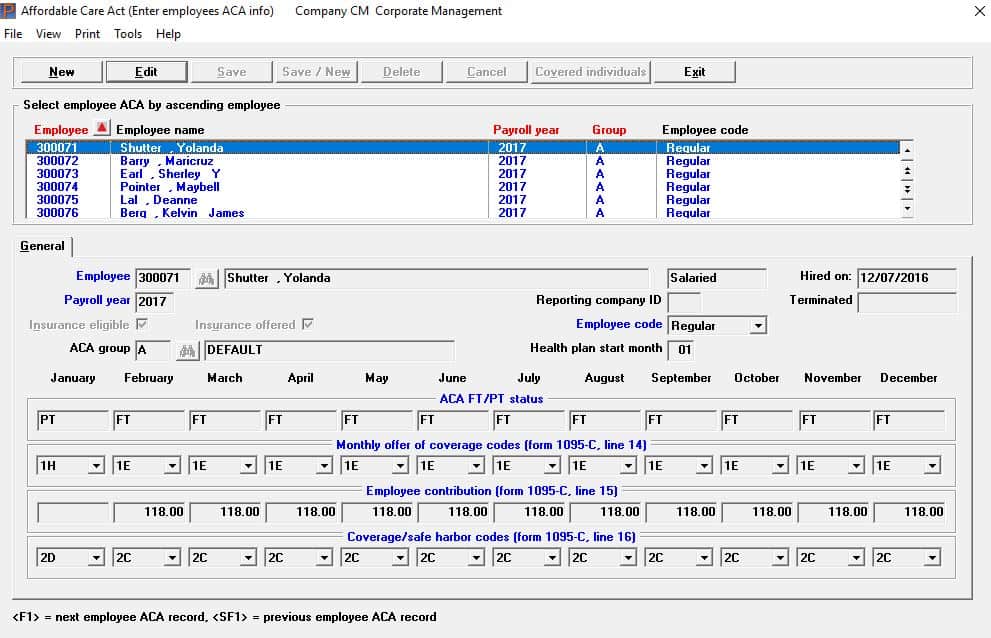

Affordable Care Act Processing

1094 C 1095 C Software 599 1095 C Software

Benefits 1095 C

Employers Are You Unsure Of The Coding On Forms 1094 C And 1095 C The Aca Times

Changes In 21 Aca Reporting Health Insurance Coverage Employment How To Plan

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

Aca Code Cheatsheet

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Aca And The Vista Hrms Fall Update

Affordable Care Act Aca Reporting Cheat Sheet Reporting Made Easy Onedigital

1094 C 1095 C Software 599 1095 C Software

Eleven Irs Form 1095 C Code Combinations That Could Mean Potential Penalties

Cobra Retiree 1095 C Form Questions Answered Tango Health

What Is Form 1095 C Filing Methods Due Dates Mailing Address

What Your Clients Need To Know About Form 1095 C Accountingweb

Eleven Irs Form 1095 C Code Combinations That Could Mean Potential Penalties

A Z Important Terms To Know For Forms 1094 1095 C Ts1099 Ts1099

Explanation Of 2d On Line 16 Of The Irs 1095 C Form Integrity Data

The Codes On Form 1095 C Explained The Aca Times

United Benefit Advisors Home News Article

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

Annual Health Care Coverage Statements

trix Irs Forms 1095 C

Changes Coming For 1095 C Form Tango Health Tango Health

1095 C Faqs Office Of The Comptroller

Aca Code Cheatsheet

Aca Code Cheatsheet

Irs Announces Changes With Aca Reporting Forms And Instructions Onedigital

Aca Code Cheatsheet

Streamlined Aca Reporting Methods Abd Insurance Financial Services

1095 C Form Official Irs Version Discount Tax Forms

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Irs Form 1095 C Fauquier County Va

Ez1095 Software How To Print Form 1095 C And 1094 C

How Can I Get Help With 1095c Instructions Obamacare Facts

1095 C Reporting How To Use Affordability Safe Harbors For Integrity Data

0 件のコメント:

コメントを投稿